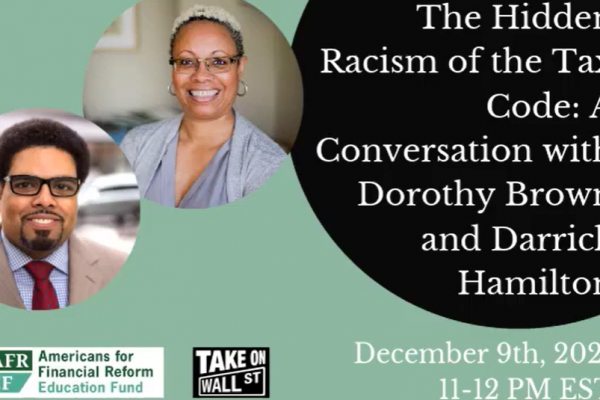

Event: The Hidden Racism of the Tax Code: a Fireside Chat with Dr. Dorothy A. Brown & Dr. Darrick Hamilton

The Take on Wall Street campaign of Americans for Financial Reform hosted a virtual fireside chat with Dr. Dorothy A. Brown, Professor of Law at Emory University and author of The Whiteness of Wealth and Dr. Darrick Hamilton, director of the Institute for the Study of Race, Power and Political Economy at The New School, to discuss the white supremacy inherent in our tax code and how American tax policies impoverish Black Americans while enriching white Americans, and how we can restructure our system to focus on justice and equity.