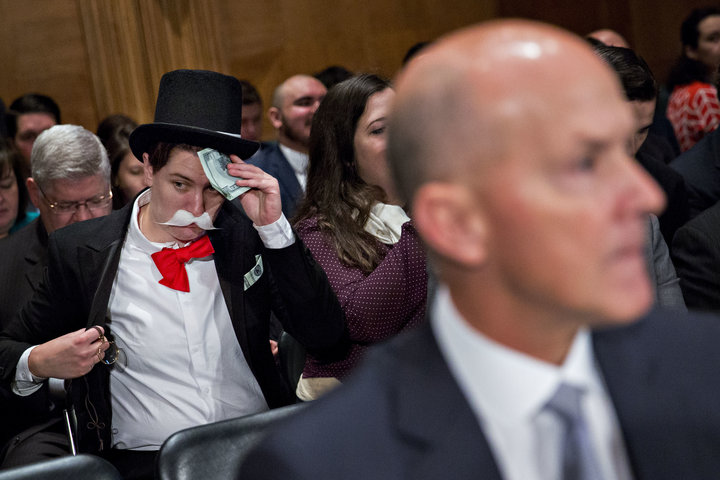

Monopoly Man Crashes Equifax Hearing to Protest Forced Arbitration

Americans for Financial Reform and Public Citizen fought the attack on the Consumer Bureau’s rule to limit forced arbitration and class action bans by delivering mock “Get-Out-of-Jail-Free” cards to the Senate.

Rigged-Rules-768×454 Community-Cheat-768×454

In addition, Amanda Werner appeared at Wednesday morning’s U.S. Senate Banking Committee hearing on Equifax dressed as the billionaire Monopoly Man, and sat behind former CEO of Equifax Richard Smith as he gave testimony to the Senate Banking Committee.