AFR Report: Government Sachs And The Trump Administration

Goldman Sachs-linked appointees in the Trump administration are pursuing a broad agenda of deregulation and privatization that will directly benefit the New York investment bank.

Goldman Sachs-linked appointees in the Trump administration are pursuing a broad agenda of deregulation and privatization that will directly benefit the New York investment bank.

“Marcus Stanley, policy director for Americans for Financial Reform, expressed concern about the report’s guidance. ‘The recommendations are “almost uniformly deregulatory.’ he said. ‘It is written pretty technically, but what they are saying is that a lot of things that were done after the crisis to try increase our safety margins and improve our risk control on derivatives they want to cut back on.’”

“In 2013, the FDIC and OCC issued guidance aimed at curbing the harms of these debt trap loans. At the same time, the Federal Reserve issued a supervisory statement to the same end… But today, banks are attacking the FDIC and OCC protections that have prevented banks from trapping people in unaffordable payday loans.”

We write to ask for the bank’s pledge that it will not begin making payday loans, and that it will oppose the

rollback of the regulatory guidance, which would make it easier for other banks to do so.

“Consumer advocates say tougher rules are needed because lenders often prey on desperate borrowers who are living paycheck to paycheck by trapping them in debt. ‘Payday and car title lenders profit from repeatedly dragging hard-pressed people deeper and deeper into debt, and taking advantage of families when they are financially vulnerable,’ Lisa Donner, the Americans for Financial Reform’s executive director, said in a statement. ‘Curbing the ability to push loans that borrowers clearly cannot repay is a key protection.’”

“A federal regulator announced new restrictions Thursday on the payday lending industry, a move that is likely to face resistance in Congress. The Consumer Financial Protection Bureau’s finalized rules largely reflect what the agency proposed last year. They are the first nationwide regulation of the industry, which had largely been left to the states.”

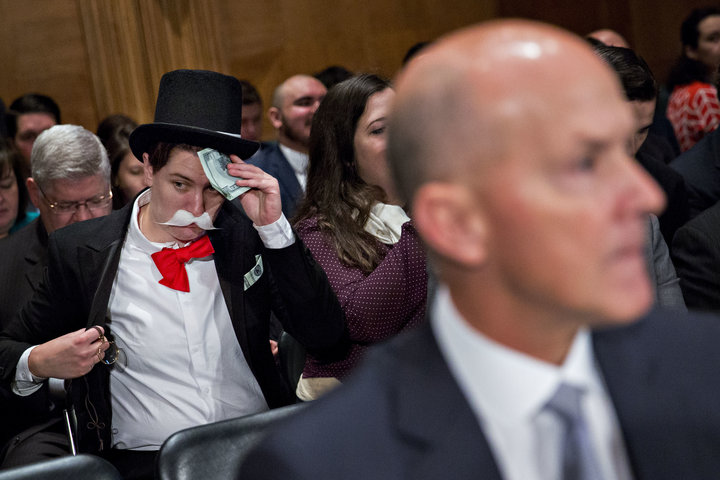

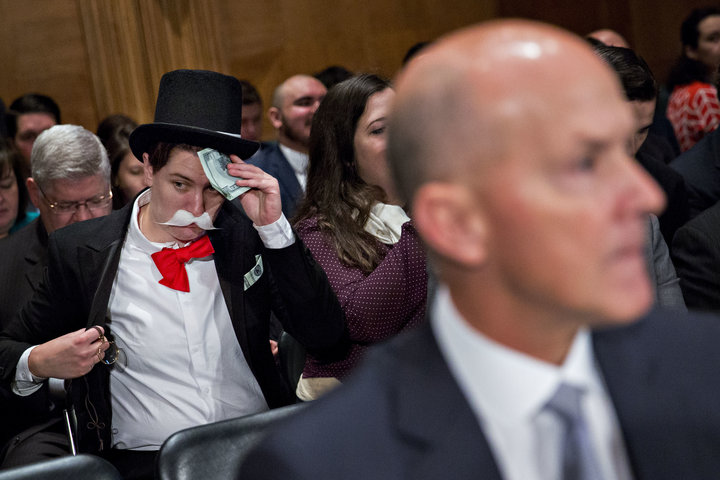

“A person dressed as the Monopoly Man (aka ‘Uncle Pennybags’) landed some prime real estate at a Senate banking committee hearing, seated behind Equifax CEO Richard Smith in a live-action photobombing… Amanda Werner [of Americans for Financial Reform and Public Citizen] walked into the committee hearing with a giant ‘Get Out Of Jail Free’ card for Equifax and Wells Fargo, with the statement ‘forced arbitration lets financial institutions escape accountability for wrongdoing.’”

“Monopoly Man became the Internet crush of the day on Wednesday, after upstaging former Equifax CEO Richard Smith at a Senate hearing on the company’s massive data breach. The board game character, whose name is Rich Uncle Pennybags, was brought to life by Amanda Werner, an arbitration campaign manager for Public Citizen and Americans for Financial Reform, groups that advocate for consumer rights and protections.”

“At the heart of the rule is the common sense principle that lenders check a borrower’s ability to repay before lending money. While praising the CFPB for pushing to stop the debt trap, the coalition calls on the Bureau to build on this progress by quickly working to develop regulations to protect consumers from abusive long-term, high-cost loans. Also, strong state laws, such as rate caps, must continue to be defended and enacted.”

Americans for Financial Reform and Public Citizen fought the attack on the Consumer Bureau’s rule to limit forced arbitration and class action bans by delivering mock “Get-Out-of-Jail-Free” cards to the Senate.

Rigged-Rules-768×454 Community-Cheat-768×454

In addition, Amanda Werner appeared at Wednesday morning’s U.S. Senate Banking Committee hearing on Equifax dressed as the billionaire Monopoly Man, and sat behind former CEO of Equifax Richard Smith as he gave testimony to the Senate Banking Committee.

“Courts and multiple agencies have found – and Wells Fargo has admitted – that the bank has repeatedly ‘violat[ed] laws or regulations.’ In addition, Wells Fargo’s prudential regulator, the Office of the Comptroller of the Currency (OCC), has found the bank’s violations constitute ‘unsafe or unsound practices.’ By statute, either of these criteria is sufficient grounds for termination of a bank’s deposit insurance.”