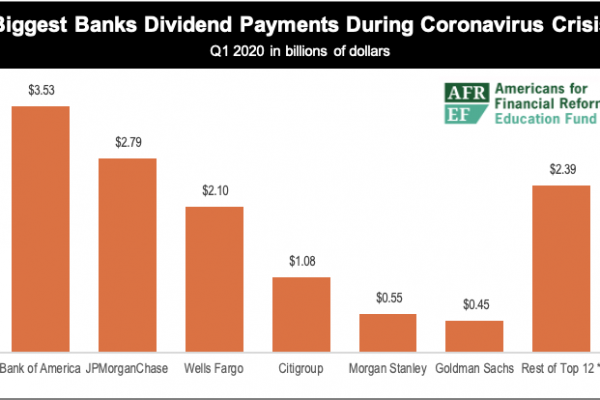

Policy Recommendations: Recommendations for Systemic Reform to Create a Safe and Just Financial System

AFR released a recommended set of systemic reforms outlining steps to create a safe and just financial system. These include both reversing the deregulation of the Trump years and taking positive steps to create a far more secure and inclusive financial system. The full document