Letters to Regulators: AFREF Comment Letter on CFPB Task Force RFI

AFREF comment letter opposing the formation and work of the CFPB Task Force on Federal Financial Law.

AFREF comment letter opposing the formation and work of the CFPB Task Force on Federal Financial Law.

Letter from over 90 groups calling on the CFPB to stop all regulatory activity unrelated to COVID-19 and take greater steps to protect consumers during the pandemic.

Joint letter asking FHFA, HUD, VA and USDA to provide tenants with a mechanism to identify whether their apartment, home, or manufactured housing is covered by the tenant protections in the CARES Act

Coalition letter to FHA on clarifying and improving protections for borrowers facing hardship related to covid-19.

Americans for Financial Reform Education Fund sent a letter to the Federal Reserve Board, urging them to avoid any actions which would permit the financial holding companies or any of their subsidiaries to directly or indirectly operate oil or gas companies. The letter highlights the manifold physical, economic, reputational and financial system risks of bank commodity holdings, risks have become even more severe with the recent dislocation in global energy markets. As these markets will be disrupted for an extended period, the letter asks the Board to firmly reject any effort by banks to use the situation with respect to defaulting loans in the energy industry to increase bank involvement in the oil and gas industry.

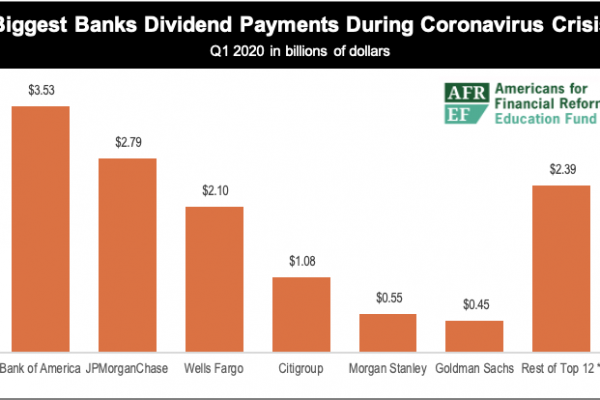

At the peak of the coronavirus pandemic, big banks will be paying some $13 billion in shareholder dividends. If this level of dividends continues for the rest of 2020, big banks could be permitted to pay out over $50 billion in dividends for 2020.

Letter to HUD asking for needed protections for reverse mortgage borrowers facing challenges due to COVID-19

AFR Education Fund and 46 other organizations sent a letter to regulatory agencies urging them to suspend all non-COVID-19 rulemaking activity. Public advocates and regulatory agencies should focus all resources on responding to the public health emergency and the economic crisis.

AFR Education Fund and 46 other organizations sent a letter to regulatory agencies requesting extensions of all public comment periods during the COVID-19 emergency.

The COVID-19 pandemic requires an aggressive economic response that creates the best possible conditions to preserve public health and helps individuals, families, and communities weather the disruptions that efforts to contain the pandemic require.