News Release: Report Outlines KKR’s Harm to Frontline Communities As it Continues to Center a Fossil Fuel Strategy

A new report examines how Kohlberg Kravis Roberts & Co. and its affiliates have run three liquefied natural gas (LNG) investments.

A new report examines how Kohlberg Kravis Roberts & Co. and its affiliates have run three liquefied natural gas (LNG) investments.

AFREF submitted comment letters to the Financial Stability Oversight Council (FSOC) on two proposals that would strengthen its toolbox for addressing threats to financial stability, including those related to climate change, and make it easier to designate nonbank companies like asset managers and insurance companies as systemically important institutions that need enhanced regulation by the Federal Reserve Board.

The letters detail how threats to financial stability from nonbank financial institutions are growing, and it encourages FSOC to quickly strengthen and finalize its proposals to be able to respond effectively and proactively to emerging risks. Many nonbank financial institutions already face heightened stress from large climate-related shocks, including several major insurers’ recent decisions to withdraw coverage from many states and zip codes. Insurance companies, asset managers, private equity firms, and other nonbank financial institutions are also creating significant risks to the financial system through their insured or financed emissions — risks that are often forced upon other financial institutions and consumers who will struggle to manage them.

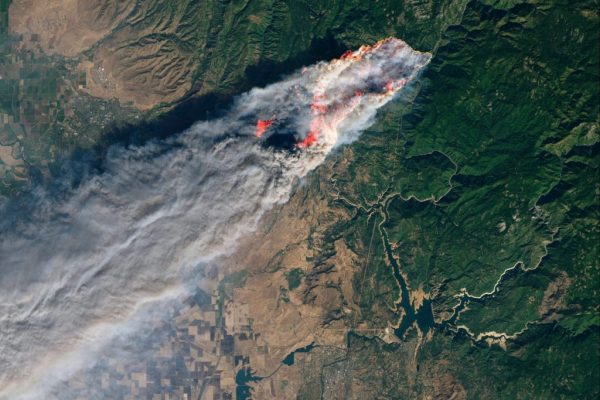

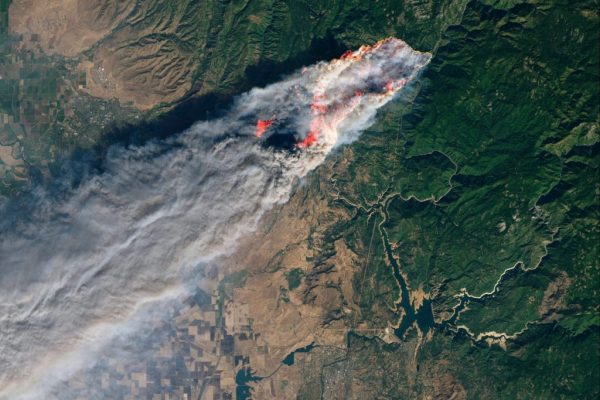

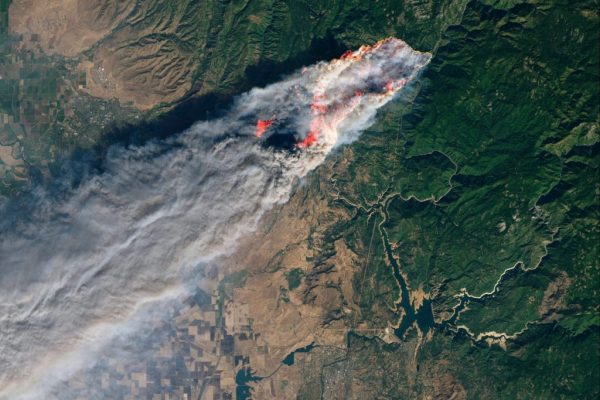

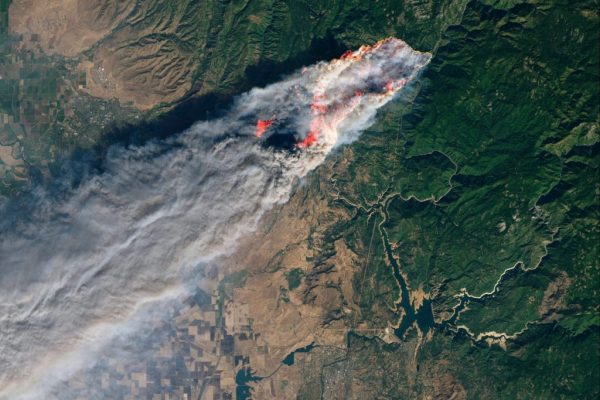

A new investigation released today reveals that the Carlyle Group (Carlyle), a private equity titan with $373 billion in assets under management, has been quietly scooping up fossil fuel assets over the past decade, in contravention of its stated climate goals.

AFREF submitted a comment letter in response to the Environmental Protection Agency’s request for information for the Environmental and Climate Justice Block Grant Program (ECJ Program), which provides funding for financial and technical assistance to carry out environmental and climate justice activities to benefit disadvantaged communities. The letter highlights the need for the ECJ Program to minimize barriers for the most climate-vulnerable applicants, prioritize the needs and perspectives of all underrepresented or historically marginalized community members, and prioritize projects that combat the harmful effects of bluelining by financial service providers.

WASHINGTON, D.C. — The Environmental Protection Agency (EPA) released its initial program design guidance for the Greenhouse Gas Reduction Fund (GHGRF or “fund”). This key environmental justice and climate provision of President Biden’s Inflation Reduction Act will help provide direct investment toward climate mitigation and resilience projects in communities across the country.

The Federal Reserve pilot climate scenario analysis to spur six major U.S. banks to evaluate their climate risks represents a necessary step towards getting these financial institutions to understand their transition risks and the severe physical threats on their residential and commercial real estate portfolios. But there needs to be a more assertive approach to how megabanks manage their climate risks.

WASHINGTON, D.C. — The U.S. Department of Labor’s final rule takes an important step to safeguard the savings of millions of workers who participate in private-sector employee benefit plans by allowing workers’ private retirement plans and pensions to consider sustainability factors like climate change, workers’ rights, racial, economic and environmental justice, and corporate governance when investing and voting proxies.

The Carlyle Group, Warburg Pincus, and KKR are the top three offenders on climate among private equity firms, continuing to invest in polluting industries and exposing investors to significant climate-related risk, according to a new scorecard developed by the Private Equity Stakeholder Project (PESP) and Americans for Financial Reform Education Fund (AFREF).

The SEC’s regulatory agenda is under attack, and Chair Gary Gensler is appearing before the Senate Banking Committee tomorrow. This memo for the media addresses the SEC’s work across eight different areas.

More than 90 organizations—including the Action Center on Race and the Economy (ACRE) and Americans for Financial Reform Education Fund (AFREF) —submitted two comment letters to the Securities and Exchange Commission (SEC) today urging the agency to enshrine stronger rules for environmental, social, and governance (ESG) investing to stop the current practice of “greenwashing.”