Results tagged with “CFPB”

CFPB

Commentaries & Press

CFPB

Commentaries & Press

CFPB

Commentaries & Press

CFPB

Commentaries & Press

CFPB

Commentaries & Press

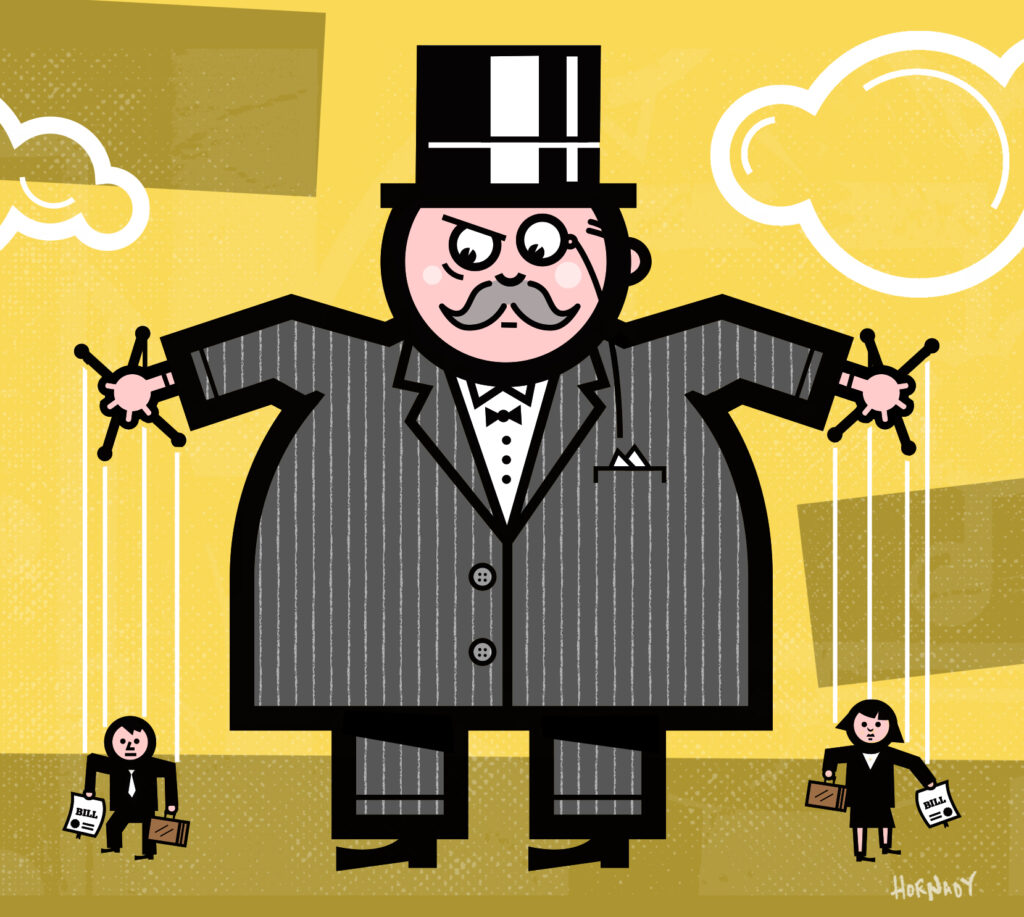

Big Banks & Wall Street CFPB Take On Wall Street

Commentaries & Press

January 30, 2018