News Release: NYC Comptroller Brad Lander Announces Asset Manager Accountability Policy on Earth Day

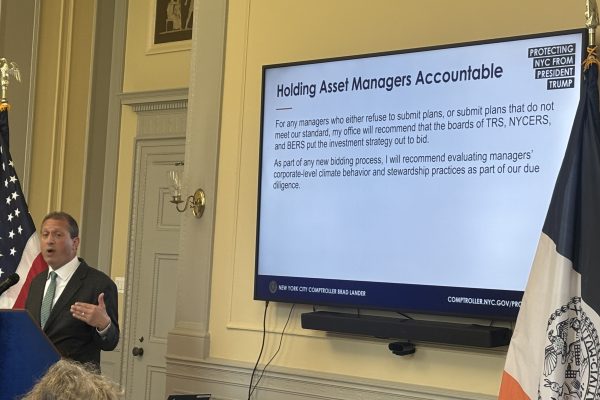

NYC Comptroller Brad Lander announced standards by which he will evaluate the net zero plans of the asset managers that oversee the city’s pension assets. He will recommend the boards of trustees of the city’s pensions pursue other asset management options through a bidding process should some of their current asset managers fail to meet those standards.