Policy Recommendations: AFR Education Fund Financial Policy Responses to the COVID-19 Pandemic

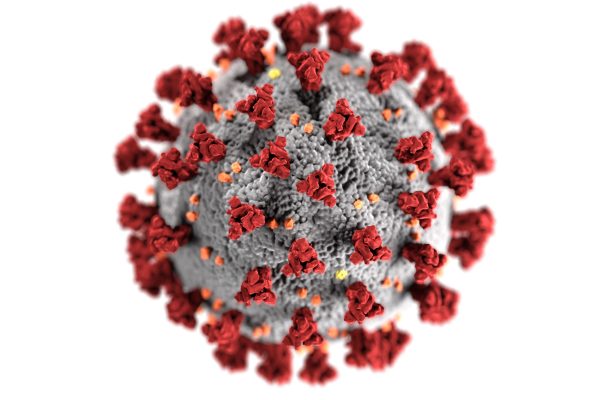

The COVID-19 pandemic requires an aggressive economic response that creates the best possible conditions to preserve public health and helps individuals, families, and communities weather the disruptions that efforts to contain the pandemic require.