Take Action: Call Congress and demand they stop the attack on the CFPB

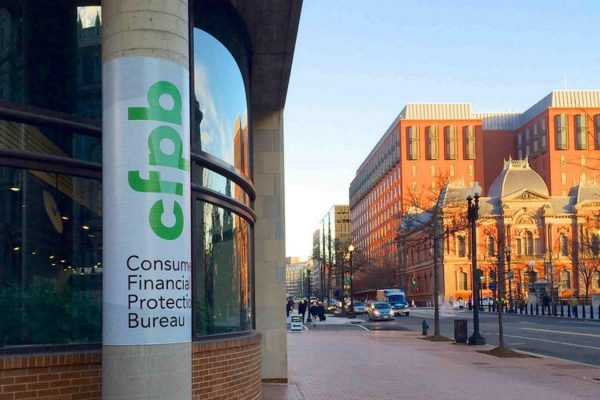

The Consumer Financial Protection Bureau (CFPB) is under attack right now in Congress and by the Trump administration like never before. Not only are Elon Musk, Wall Street and their allies in Congress working to completely defund and shut down the CFPB, efforts are underway