Letters to Regulators: Letter to CFPB on Need for Greater Debt Collection Protections for LEP Consumers

Letter from 26 groups to the CFPB urging the agency to strengthen protections for LEP consumers in the next part of the debt collection rule.

Letter from 26 groups to the CFPB urging the agency to strengthen protections for LEP consumers in the next part of the debt collection rule.

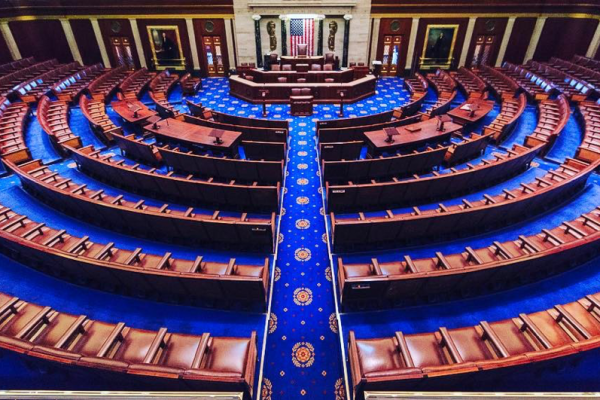

The November 2020 version of “Where Members of the 116th Congress Stand on Financial Reform” documents how Members voted on over thirty legislative measures concerning consumer protections, housing, Wall Street and the financial industry, from January 2019 to November 2020.

Americans for Financial Reform Education Fund (AFREF) and Main Street Alliance (MSA) respectfully urge the Small Business Administration (SBA) to maintain the information collection under the Paycheck Protection Program (PPP) new Loan Necessity Questionnaire for recipients and encourage the SBA to support robust supplemental disclosure requirements for PPP recipients.

Thank you for your strong commitment to opposing the Office of the Comptroller of the Currency (OCC)’s efforts to help tech companies dodge regulatory oversight, mix commerce and banking activities, and avoid compliance with consumer protection laws.

The Treasury Secretary has the authority to drive an ambitious agenda for economic, racial, and climate justice, and to use financial regulation as an important tool of that work. As Yellen has herself noted in recent remarks, this moment of crisis has made it particularly clear that a new administration needs to not only undo the dangerous Trump administration deregulation of Wall Street, but also move well beyond the preceding status quo.

AFR released a recommended set of systemic reforms outlining steps to create a safe and just financial system. These include both reversing the deregulation of the Trump years and taking positive steps to create a far more secure and inclusive financial system. The full document

Kraninger should resign, but if she does not her record makes it overwhelmingly clear that the incoming administration needs to fire her as soon as President-Elect Joe Biden takes office on Jan. 20 and replace her with an acting director who will steer the CFPB back to fulfilling its mission.

Kathleen Kraninger, the current director of the Consumer Financial Protection Bureau, told an audience of bankers at a November 2019 industry gathering that “you are really helping drive the agenda.” Unfortunately for the public and for consumer financial protection, the Kraninger agenda and the Wall Street lobby’s priorities are indeed all too similar, even during the COVID-19 pandemic and massive economic distress.

Today, over 235 organizations sent a letter to President-Elect Biden and Vice President-Elect Harris, calling on them to use executive authority to cancel federal student debt on day one of their administration.

239 organizations signed a letter to President-Elect Biden and Vice President-Elect Harris, calling on them to use executive authority to cancel federal student debt on day one of their administration. The letter was led by Americans for Financial Reform, the Center for Responsible Lending, Demos, the National Consumer Law Center, and Student Borrower Protection Center.