Letters to Regulators: Letter to the CFPB on the Need for Action to Limit Forced Arbitration

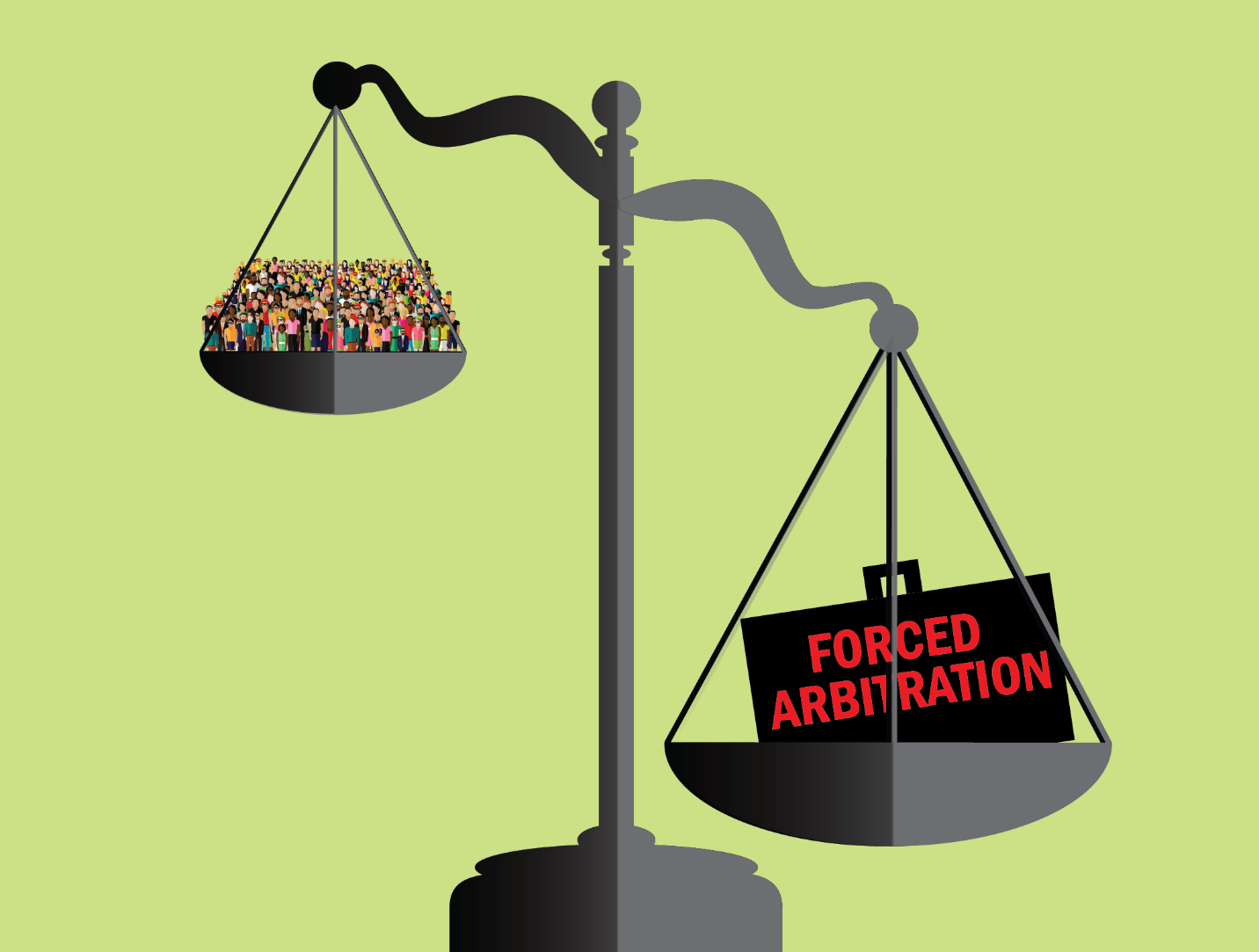

AFREF joined a letter to the CFPB urging it to take action on the ongoing issue of forced arbitration in consumer financial services/products.

AFREF joined a letter to the CFPB urging it to take action on the ongoing issue of forced arbitration in consumer financial services/products.

AFR joined a letter to Congress supporting Senator Blumenthal’s amendment to the National Defense Authorization Act (NDAA), to ban forced arbitration for service members suffering financial and employment abuse.

AFR joined a letter strongly supporting the Force Arbitration Injustice Repeal Act (FAIR Act). The letter stated that the legislation would ensure that workers, consumers, servicemembers, nursing home residents, ordinary investors, and small businesses harmed by bad actors will be able to bring valid claims in court, and would not be forced into private, secretive, corporate-controlled arbitration systems required by nonnegotiable contracts. It argued for the particular need for Congress to move forward with this legislation in light of the economic hardship facing working families during the pandemic.

The measure, which is scheduled for a vote at the company’s annual meeting next week, would block investors harmed by securities fraud or other corporate legal violations from bringing their claims as a class in a court of law, before a judge and jury. This would effectively end most shareholders’ ability to recover their losses in such cases, as they cannot affordably be brought individually in arbitration by any but the very largest institutional investors.

In a recent email to credit card holders, JPMorgan Chase notified its existing customers that they will now be subject to forced arbitration for any past and future dealings with the company. The new policy, which affects 47 million accounts, strips customers of their rights

On the first anniversary of the Trump administration, the Take on Wall Street coalition catalogs the ways that Wall Street made bank on Trump in 2017.

“’President Trump had a clear choice to make today between Wall Street and the rest of us,’ said Amanda Werner of Americans for Financial Reform and Public Citizen. ‘He chose Wall Street. But the rest of us will keep fighting to restore our rights so we can fight back the next time a company like Wells Fargo or Equifax tries to rip us off and get away with it.’”

“‘This vote marks a truly shameful moment in Congress,’ [AFR’s] Amanda Werner, who plays the Monopoly Man, said in a statement. ‘Just weeks after holding hearings on scandals of historic proportion, the Senate granted Equifax and Wells Fargo a Get Out of Jail Free card. Rather than pass meaningful legislation to help the 145 million Americans harmed by the data breach, a slim Republican majority chose to take away our only chance at holding financial giants accountable.’”

“The {Wells Fargo and Equifax) scandals put a human face on the practice of companies forcing customer disputes through a secret, non-judicial process… Americans for Financial Reform addressed this directly in a video featuring a woman with disabilities and a veteran, who were ripped off by Wells Fargo and then prevented from a day in court because of an arbitration clause. To pursue such cases, which typically involve small amounts of money, through arbitration, victims need to spend heavily on legal representation and hearings. As federal Judge Richard Posner of the 7th Circuit Court of Appeals once wrote in a ruling, ‘The realistic alternative to a class action is not 17 million individual suits, but zero individual suits, as only a lunatic or a fanatic sues for $30.’”