Yet Another Anti-ESG Congressional Hearing

Culture War-Laden Antitrust Claims Debunked & Responsible Investing Defended

By Meron Lemmi

The recent congressional hearing on Wednesday, June 12th, about Environmental, Social, and Governance (ESG) investing, featured unfounded, culture war-laden antitrust claims that witnesses and minority leaders easily debunked. During the spectacle, some members of Congress targeted witnesses from a sustainability nonprofit (Ceres), a public pension fund providing retirement security to over two million workers (CalPERS), and an impact investor (Arjuna Capital). These witnesses and others provided reasoned defenses of responsible investing, highlighting its importance for long-term financial stability, risk-management, and climate resilience.

Culture War-Laden Antitrust Claims

From the outset, the committee majority framed the hearing as an investigation into supposed antitrust violations by ESG investors. They claimed that ESG initiatives represent collusion and conspiracy to impose “radical” environmental policies. Representative Jim Jordan (R-OH-04), for instance, launched into an almost comical tirade about the supposed evils of ESG investing, including a bizarre comment about limiting hamburgers. “They even want to restrict the amount of beef we consume—one and a half hamburgers a week!” he exclaimed, as though Americans’ meat consumption is dictated by left-wing conspirators.

Rep. Matt Gaetz (R-FL-1) escalated the rhetoric, asking, “Do you ever consider someone’s skin color? Because it’s pretty immutable. People don’t choose to be white, or black, or Asian. They just are.” His questioning wasn’t just a misunderstanding of diversity, equity, and inclusion (DEI) initiatives; it was a deliberate attempt to conflate DEI with discriminatory practices. Far from being discriminatory, DEI practices are legally sound and widely recognized for reducing risks and fostering a more inclusive workplace culture. Gaetz’s approach is part of a broader, misguided strategy by some Republicans to frame DEI and responsible investing considerations as unnecessary or even harmful despite evidence to the contrary.

Claims Debunked

The partisan accusations of antitrust violations are not only unfounded but also ridiculous. Antitrust laws prohibit agreements among competitors that unfairly restrain competition, such as price-fixing or dividing up markets. ESG initiatives do not fit this definition. As other representatives and witnesses pointed out, ESG practices involve investors independently considering the long-term risks and opportunities related to environmental, social, and governance factors. These practices are not about collusion but about managing risks and maximizing returns responsibly.

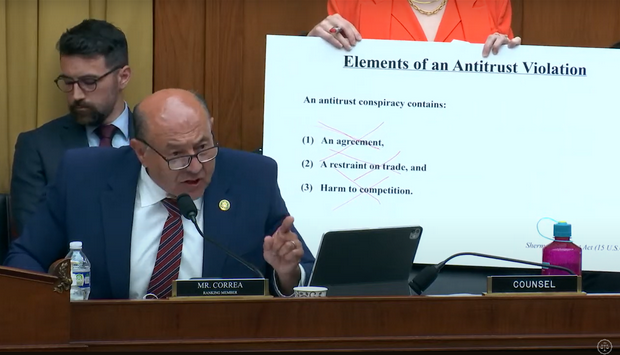

Rep. Lou Correa (D-CA-46), the ranking member of the House Judiciary Subcommittee on the Administrative State, Regulatory Reform, and Antitrust shown above, cut to the heart of the matter by going through the elements of an antitrust violation, demonstrating that not a single one was met based on the facts included in the majority’s report. “This hearing is not about antitrust law or antitrust violations. This hearing is about going after responsible fiduciary investing and shareholders who are essentially exercising their legal rights under the law,” he said.

Minnesota Attorney General Keith Ellison – who has litigated his fair share of antitrust cases – also set the record straight, clarifying that ESG considerations do not violate antitrust laws. He explained, “Antitrust laws do not prohibit businesses or individuals from exercising their First Amendment right to work together to influence legislative or regulatory policy.” The Supreme Court has upheld this principle for over 60 years, recognizing the right of companies to collaborate on public policy issues. Furthermore, businesses independently choosing similar strategies to manage risks, such as those posed by climate change, does not constitute illegal collusion.

Responsible Investing Defended

Contrary to the majority’s baseless claims, responsible investing seeks to maximize sustainable value creation over the long-term and minimize risks from climate change, extreme economic inequality, racial inequity, poor governance, and more. Mindy Lubber, CEO of Ceres, highlighted during the hearing that climate change poses both risks and opportunities for investors. Responsible investors, by integrating these considerations, are making choices that are not just ethically sound but also financially prudent. Natasha Lamb of Arjuna Capital emphasized that accounting for ESG factors helps manage risks and capitalize on opportunities, leading to better long-term performance.

In addition to the compelling testimonies from witnesses, some representatives provided clear, evidence-based defenses of responsible investing. They emphasized that ESG considerations are essential for managing long-term risks and ensuring financial stability, particularly in the face of climate change.

For example, Rep. Becca Balint (D-VT-AL) provided a poignant reminder of the real-world impacts of climate change, describing the devastation in her home state of Vermont. “We see destruction, destroyed houses, flooded streets, communities ruined. American insurance rates are going through the roof if they even get insurance. Back home, a lot of homeowners can’t get insurance today,” she said. Balint’s remarks highlighted the urgency of the climate crisis that investors ignore at their peril.

Given that witnesses and minority members successfully debunked the claims and defended responsible investing, why did this hearing happen at all? Rep. Jerrold Nadler (D-NY-12), ranking member of the House Judiciary Committee, has an answer: “This investigation is really about a shadow campaign by the far right and their allies in the oil and gas industry to inject their crusade against sensible climate policy into corporate boardrooms.” Let’s not let them.