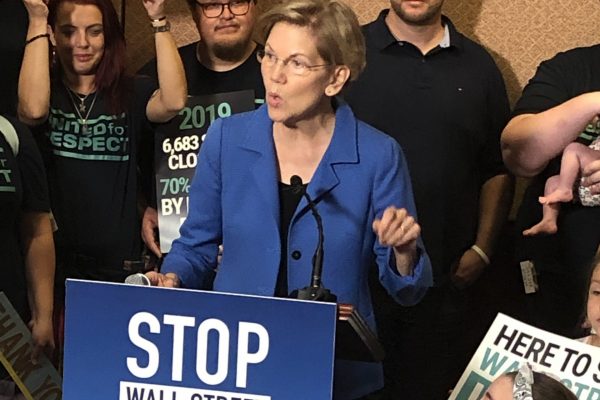

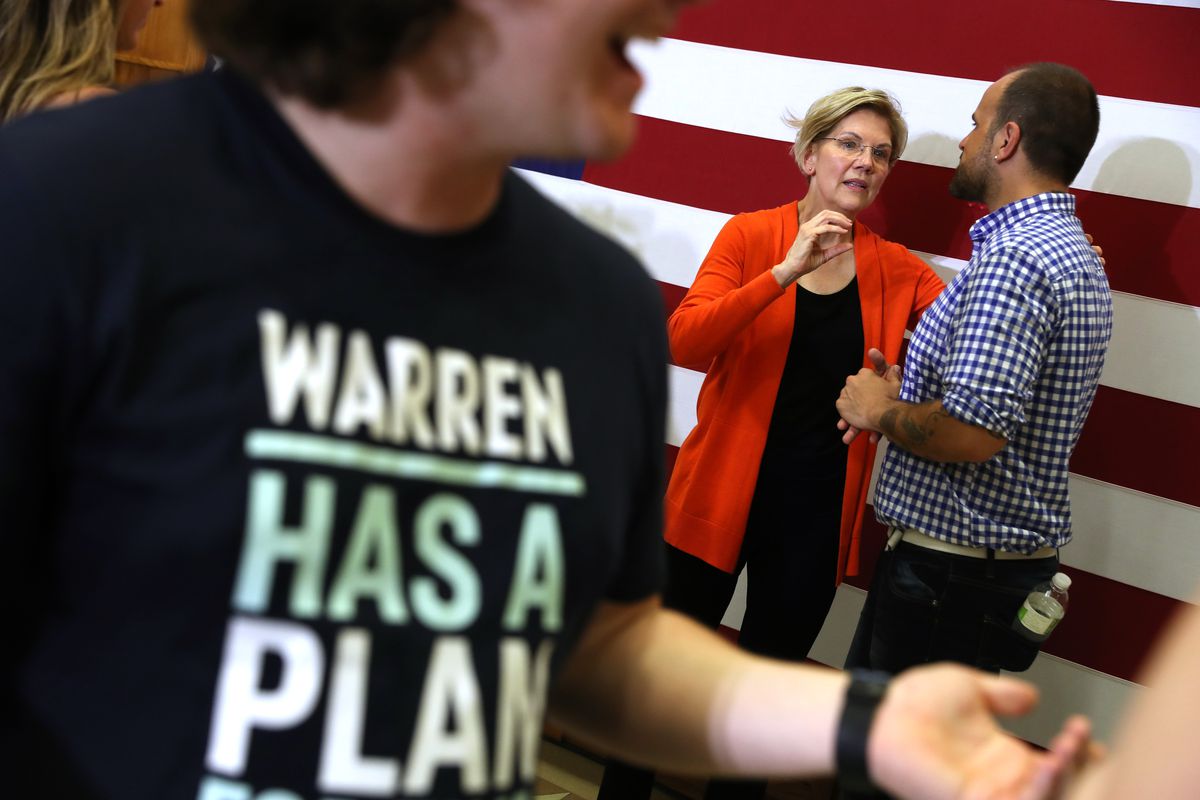

Blog Post: Wall Street and private equity are “gobbling up homes,” driving inflation and exacerbating the housing crisis

In a House Financial Services Committee hearing from the beginning of March, both Representatives and witnesses discussed how Wall Street and private equity are causing housing prices to soar and driving inflation.