AFR Statement on Proposals by Senators Brown and Vitter

AFR issued a statement on proposals introduced by Senators Brown and Vitter in the US Senate.

AFR issued a statement on proposals introduced by Senators Brown and Vitter in the US Senate.

“Think of the precedent… rushing forward with the aspects of the rule supported by industry while offering the faint possibility that the commission might one day get around to addressing the concerns raised by investors.”

AFR sent a letter to members of Congress expressing strong support for President Obama’s proposal in the 2014 budget to increase funding for the CFTC.

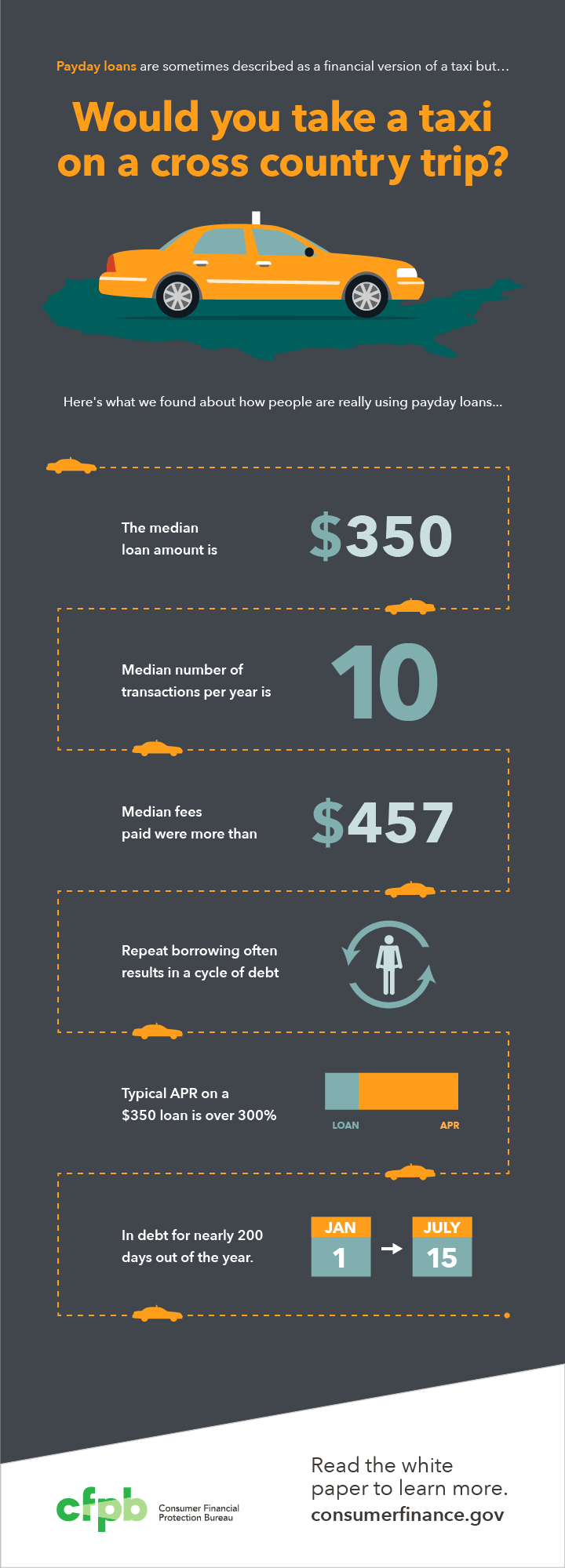

Confirm Richard Cordray as Director of the CFPB THE CONSUMER FINANCIAL PROTECTION BUREAU’S WORK IS CRUCIALLY IMPORTANTThis is the agency created after the 2008 financial crisis to establish basic rules of fairness and transparency for mortgages, credit cards, student loans, auto loans, debt collection and

AFR joined more than twenty public interest groups in sending a letter to SEC Chairman Mary Jo White advocating for effective regulation of executive compensation.

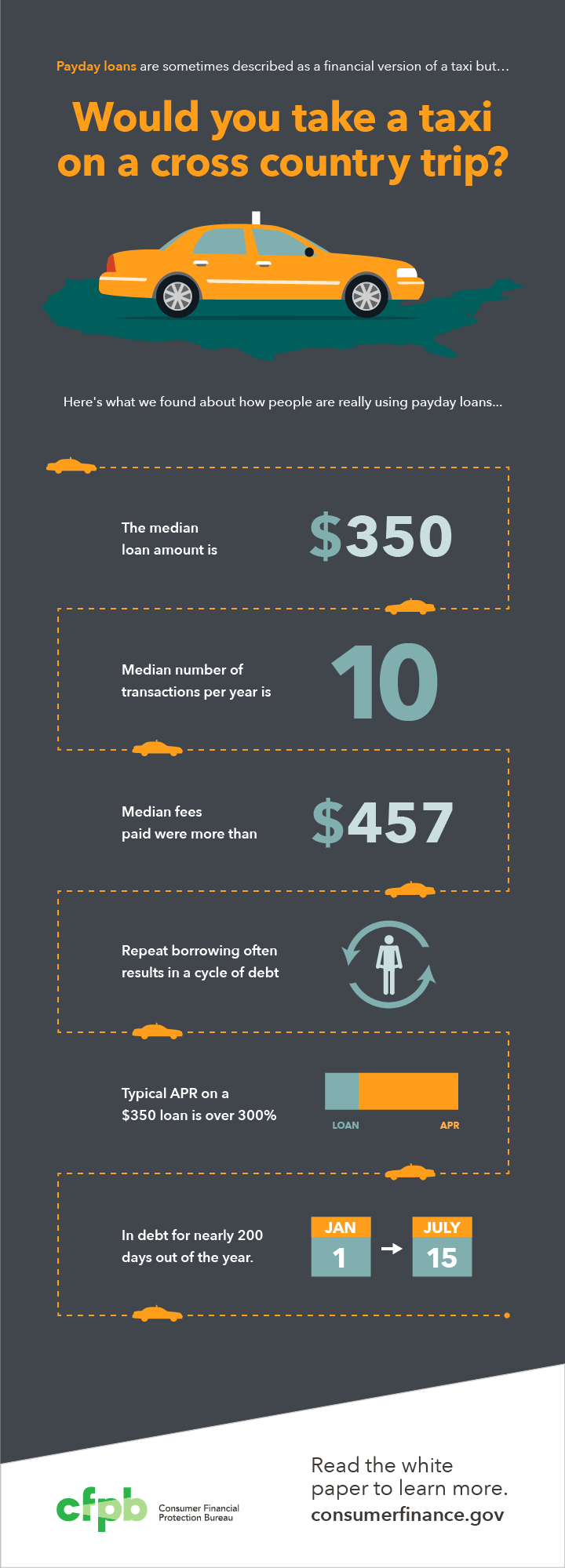

AFR joined more than 15 leaders of public interest groups in releasing a joint statement applauding the FDIC and the OCC for their proposed guidance issued this week directing banks to stop making predatory loans that trap borrowers in a cycle of debt with 300% interest.

As new data confirms, they frequently serve as debt traps, with borrowers unable to repay, taking out repeated loans, and struggling to cover basic living expenses for months on end.

“This is about a minority that doesn’t want a watchdog that will keep an eye on the big banks to make sure they don’t cheat their customers.” – Senator Elizabeth Warren.

AFL-CIO, AFR, and Consumer Federation of America sent a letter to SEC Chairman Mary Jo White arguing that the Commission needs to re-propose the general solicitation rulemaking for the JOBS act in order to incorporate basic investor protections not included in the proposed rule.

The Federal Reserve has heard plenty from U.S. banks about what’s wrong with various proposed pieces of Dodd-Frank rulemaking. Now, according to Kate Davidson of Politico Pro (April 15), the Fed is “getting an earful from foreign banks and their regulators, too.”