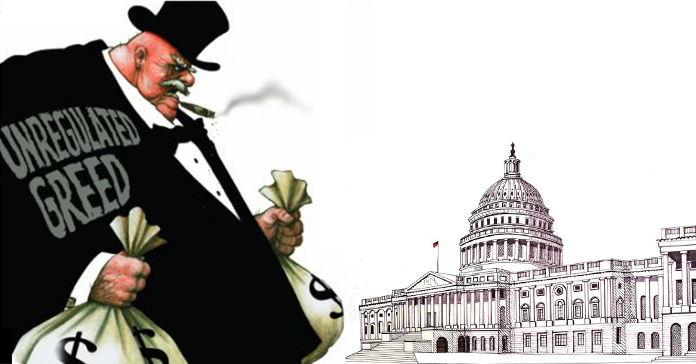

AFR IN THE NEWS: Banks Spent Record Amounts on Lobbying in Recent Election (Reuters)

“Banks and other financial companies expecting big benefits from Republican-led deregulation spent record amounts on lobbying in the last election cycle… The financial sector spent $2 billion on political activity from the beginning of 2015 to the end of 2016, including $1.2 billion in campaign contributions – more than twice the amount given by any other business sector, according to the study from Americans for Financial Reform.”