AFR Statement: Don’t Delay or Gut The Fiduciary Rule

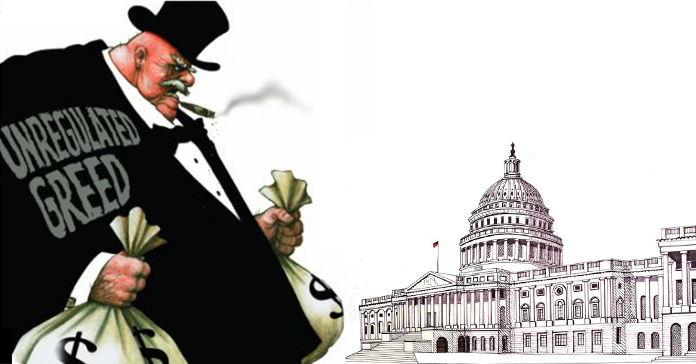

Americans for Financial Reform, a broad coalition including civil rights groups, consumer advocates, community organizations, and labor unions, today called on the Trump administration to abandon its proposal to delay a planned rule that protects ordinary investors from unscrupulous financial advisers.