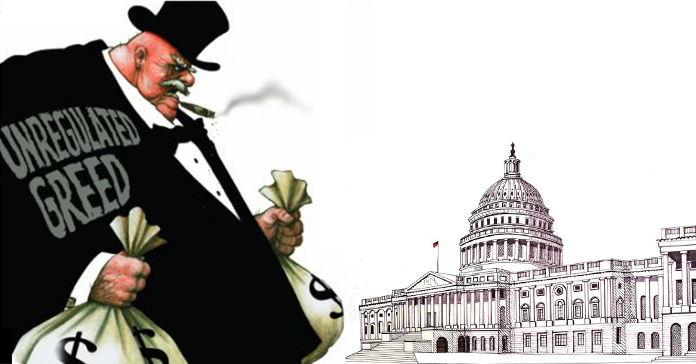

AFR in the News: Wall Street’s big bucks in 2016 (Politico)

“Wall Street pumped $2.1 billion into the political process in 2015-2016, according to a new report by Americans for Financial Reform. Big banks, hedge funds and other financial giants contributed $1.1 billion to political campaigns in the last election cycle, and spent $898 million on lobbying in Washington. The report draws on a special data set AFR obtained. We don’t know how much ‘dark money’ that Wall Street put into American politics, so these are extremely conservative numbers.”