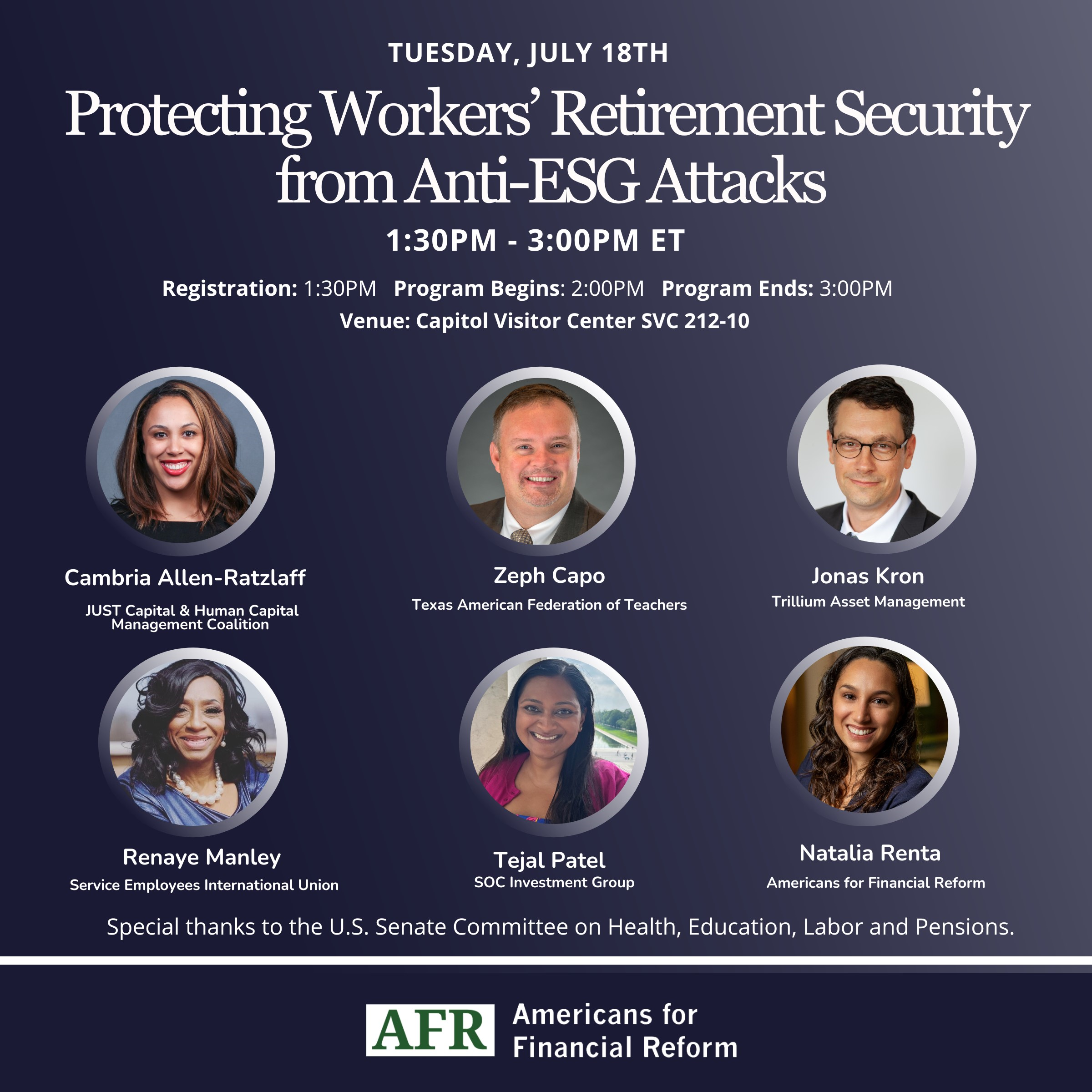

Event: Protecting Workers’ Retirement Security from Anti-ESG Attacks

Protecting Workers’ Retirement Security from Anti-ESG Attacks

Tuesday, July 18, 2023 from 1:30PM to 3:00PM ET

SVC rooms 212-10 of the Capitol Visitor Center in Washington, D.C.

The briefing was planned by Americans for Financial Reform with the sponsorship of the Senate Health, Education, Labor, and Pensions (HELP) Committee.

Come learn from experts about how anti-ESG attacks — including bills introduced by Republicans and attempts to undermine common sense financial regulations — harm workers’ retirement security and what measures can be taken to protect workers.

Panelists

- Cambria Allen-Ratzlaff, Managing Director, Head of Investor Strategies, JUST Capital & Co-Chair of the Human Capital Management Coalition

- Zeph Capo, President of the Texas American Federation of Teachers

- Jonas Kron, Chief Advocacy Officer, Trillium Asset Management

- Renaye Manley, Deputy Director of Strategic Initiatives, Service Employees International Union

- Tejal Patel, Executive Director of SOC Investment Group

- Natalia Renta, Senior Policy Counsel for Corporate Governance & Power, Americans for Financial Reform (moderator)

*Speaker bios below

Learn More

- Why are anti-ESG crusaders targeting shareholder engagement? (AFR resource)

- What regulations are anti-ESG crusaders targeting for attack and why? (AFR resource)

- What have been the key moments in hearings so far?: Social media and talking points from House Oversight Committee hearings

- What’s the large asset managers’ role in all this?

- Not doing enough on/getting in the way of racial equity (from Majority Action & SEIU)

- Not doing enough to protect their clients’ money from climate-related risks (from Majority Action)

- Why is the SEC climate-risk disclosure rule so important? (AFR resource)

- What are the anti-ESG bills being introduced in the states this year? (Pleiades Strategy)

- Who’s funding the fight to ban responsible investing? (Take on Wall Street)

- What’s the connection between housing insurance and climate change? (AFR op-ed)

- 5 Key Insights to Help Companies and Investors Lead Through Increasing Attacks on ESG and ‘Woke’ Companies (JUST Capital)

- AFR July 2023 Letter to House Financial Services Committee for the Record (Coalition)

- ICCR June 2023 Letter to Congress (Coalition)

- Q&A on the SEC Shareholder Proposal Process (Shareholder Rights Group)

Toplines

- Anti-ESG efforts are a threat to retirement security. This far-right political project exposes our retirement savings to significant financial risks that cannot be ignored, like those caused by destructive labor practices, worsening climate impacts, and excessive executive compensation.

- Far right politicians are trying to make ESG the next CRT ahead of 2024 elections. They are invoking culture wars that fuel white racial grievances for short-term profits at the expense of our communities and our future.

- The phrase “anti-woke” is little more than a thinly veiled way of saying “anti-Black.” Those on the far-right who condemn “woke capital” are responding to companies who’ve stood up for the civil rights of Black communities and our LGBTQ+ siblings.

- At its core, this fight is about how big corporations should behave in our society: should they focus on short-term, risky value extraction or long-term, sustainable value creation?

- But powerful short-term corporate interests — including fossil fuel companies looking to postpone the inevitable decarbonization of the economy — would rather not contend with a force steering them toward long-term sustainability.

- That’s why the fossil fuel industry is bankrolling efforts to stomp out the collective influence of workers using their retirement investments to push companies to address the social and environmental concerns that negatively affect them, our financial system, and retirement portfolios.

- Anti-ESG efforts seek to undermine regulations that would equip investors with more information to make better decisions about their investments and insulate the management of companies from investor input and accountability.

- Access to consistent, comparable, and decision-useful data helps investors and asset managers get a fuller picture of risks and opportunities to make investment decisions.

Winning Arguments

- Do center the fact that this money belongs to workers; we’re talking about people’s pensions, retirement savings accounts, and college savings.

- Do call out the fossil fuel interests and dark money sources behind the anti-ESG movement.

- Do explain how financial risk in the 21st century is multifaceted.

- Failure to address racial equity issues within a company creates risks for shareholders, including risk of reputational damage, litigation, and adverse policy and regulatory action.

- Companies face both physical risks resulting from climatic events, such as wildfires, storms, and floods, and transition risks from policy action taken to transition the economy off of fossil fuels.

- A company’s political spending and lobbying can present significant reputational risk if not disclosed and managed properly. Many customers and the purchasing public are paying close attention to whether a company’s lobbying lines up with its corporate values. If there is a disconnect, companies can face bad press, boycotts, or targeted social media campaigns.

- Do emphasize that anti-ESG legislation in the states has been found to result in significant costs to pensioners and the public (page 3).

- Do emphasize that anti-ESG efforts are unpopular, with 63% of voters agreeing the government should not set limits on corporate ESG investments.

- Additionally, “Most voters (76%) feel companies play a vital role in society and should be held accountable to make a positive impact on the communities in which they operate. This finding is consistent across political lines, with both the majority of Republicans (69%) and Democrats (82%) in agreement–reflecting bipartisan common ground.”

- Do emphasize the need for the SEC to propose a human capital management disclosure rule. This rule is necessary to provide investors with visibility into how public companies manage their workforce, a central component of long-term value creation.

- Do emphasize the need for a strong SEC climate-risk disclosure rule. At a time when it is undeniable that climate risk is a significant financial risk, the SEC proposed an important rule that will bring much-needed transparency to investors about how public companies are contending with climate risk and capturing emissions reduction opportunities created by new laws like the Inflation Reduction Act.

- Don’t rely, solely, on the fact that ESG funds perform better than standard investment funds. This can easily turn the conversation into a distracting back and forth about which studies are more reliable and why.

Speaker Bios

Cambria Allen-Ratzlaff, Managing Director, Head of Investor Strategies, JUST Capital & Co-Chair of Human Capital Management Coalition)

Cambria Allen Ratzlaff is Managing Director and Head of Investor Strategies at JUST Capital, leading the independent nonprofit’s investor and capital markets strategies. Cambria also co-chairs the Human Capital Management Coalition, a cooperative effort among 35 institutional investors representing over $9 trillion in assets to elevate effective human capital management as a critical driver of long-term shareholder value. Cambria is a member of the U.S. Securities and Exchange Commission’s Investor Advisory Committee and serves on the board of the International Foundation for Valuing Impacts. She was formerly a board officer for the Council of Institutional Investors. Prior to joining JUST, Cambria was Corporate Governance Director for the $61 billion UAW Retiree Medical Benefits Trust where she led the Trust’s stewardship, engagement, and proxy voting programs. Cambria previously held stewardship and governance roles at the Office of the Connecticut State Treasurer and the Council of Institutional Investors. She holds a M.A. from Trinity College (CT) and a B.A. from Bryn Mawr College.

Zeph Capo, President of the Texas American Federation of Teachers

Zeph Capo, a public school science teacher, is president of the Texas AFT and previously served as president of the Houston Federation of Teachers. He has served on several community boards, including a six-year term as an elected trustee of one of the largest community college systems in the United States, bringing community groups and schools together at all levels. Capo has served as a local union leader, central and state labor council leader, community leader and is now focused on developing local leadership and rank-and-file leaders across Texas in an effort to move the state to a pro-public education majority.

Jonas Kron, Chief Advocacy Officer, Trillium Asset Management

Jonas Kron is Trillium’s Chief Advocacy Officer. With over twenty years of experience in shareholder advocacy, Jonas is responsible for leading and coordinating Trillium’s extensive advocacy program, which works to engage companies on their environmental and social impact. His advocacy work includes direct communications with company leadership, investor education and awareness, shareholder proposals, and public policy advocacy at the municipal, state, and federal levels. As a recognized legal expert in the field and a leader in shareholder advocacy, Jonas regularly represents Trillium in the media, at public events, and with clients. Jonas currently serves on the board of US SIF – the Forum for Sustainable and Responsible Investment. Prior to joining Trillium, Jonas was an environmental attorney and public defender as well as outside counsel to many socially responsible investment organizations. Jonas holds J.D. and master’s degrees from Vermont Law School.

Renaye Manley, Deputy Director of Strategic Initiatives, Service Employees International Union

Renaye Manley brings strategy, innovation and advocacy to the world of finance and pension funds infusing a lens of racial and gender equity. She currently serves as Deputy Director of the Service Employees International Strategic Initiatives department. In this position, she works with pension trustees, investment professionals and union leaders around the engagement of multi-billion-dollar union and public pensions funds, including corporate governance and shareholder work.

She leads SEIU’s “Diversity & Dollars” work, which has led to the adoption of the “Rooney Rule” at seventeen companies, including Facebook and Amazon. She previously served on the Federal Reserve Bank of Chicago’s advisory board on Small Business, Agriculture and Labor. She serves as the advocacy committee co -chair of the Council of Institutional Investors which convenes the largest groups of investors and asset owners in the United States and also serves on the board of the 30% Coalition, an investor coalition dedicated to gender and racial equity on corporate boards.

Prior to her job at SEIU, Renaye worked for Interfaith Worker Justice, a community /labor collaboration, coordinating work with national unions and denominations on issues of workplace justice. She has a background as field organizer, working for years at the AFL-CIO where she focused on field campaigns on political and worker organizing. She is a graduate of Indiana University and has a MBA from Western Governors University.

Tejal Patel, Executive Director of SOC Investment Group

Tejal joined the SOC Investment Group in 2016, where she focuses on corporate accountability and shareholder advocacy. In her current role, she has worked with investor coalitions on issues like opioids accountability and racial equity audits where she developed strategies for issuer engagement, shareholder proposals, and asset manager outreach. Prior to the SOC, Tejal was a Senior Associate at Institutional Shareholder Services (ISS), where she worked with asset owners and asset managers in the development and implementation of their proxy voting guidelines. Before ISS, Tejal was an Associate at a Connecticut-based law firm, where she represented institutional lenders in a variety of commercial finance transactions and advised public and private companies on securities law related matters. She currently serves as a director and the Labor Constituency Co-Chair for the Council of Institutional Investors (CII) and previously served on the U.S. Asset Owners Advisory Council from 2019-2021. She holds a J.D. from the University of Connecticut School of Law and a MSc. from the London School of Economics.

Natalia Renta, Senior Policy Counsel, Corporate Governance and Power at Americans for Financial Reform

Natalia is the Senior Policy Counsel for Corporate Governance and Power at Americans for Financial Reform, where she works to change the structures of corporate decision-making to build a more equitable and sustainable economy. Prior to joining AFR, Natalia was a Senior Policy Strategist at the Center for Popular Democracy, where she provided policy and legal counsel to several campaigns, including those related to Puerto Rico’s debt crisis. Prior to that, Natalia was an attorney at Make the Road New York, an organization that builds the power of immigrant and working class communities to achieve dignity and justice. She earned her J.D. from Stanford Law School and her B.A. from Harvard University.