Paper: Lifting the Curtain on Private Equity

In partnership with The American Federation of Teachers, AFREF released a paper entitled “Lifting the Curtain on Private Equity: A Guide for Institutional Investors and Policymakers.”

In partnership with The American Federation of Teachers, AFREF released a paper entitled “Lifting the Curtain on Private Equity: A Guide for Institutional Investors and Policymakers.”

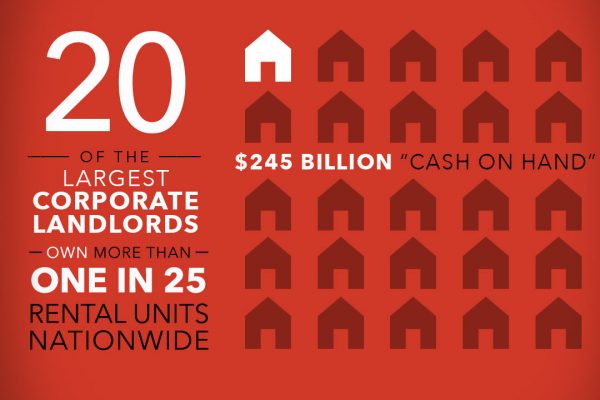

New report showing how a handful of billionaire corporate landlords increased their wealth by $24 billion during the pandemic and have raised over $245 billion to tighten their grip on the housing sector. Meanwhile millions of families are under imminent threat of eviction.

Case study of a South Carolina tire factory owned by a global corporation that received a substantial loan from the Small Business Administration for pandemic relief while many genuinely small businesses were unable to access the program.

AFR released recommendations for “Day One” policy actions by the Biden Administration in the areas of banking regulation, securities and markets regulation, and addressing systemic risk. These are actions that could be taken without a lengthy rulemaking and would make immediate progress toward a fairer

Private equity pillaging of the retail industry has cost over half a million jobs amid over 18,000 store closures through February 2020, according to a new study, the first to examine job losses at the state level. The job losses occurred in every state, with more than 10,000 jobs lost in 20 states and more than 30,000 lost in California, Florida, and New York.

Private equity has had a disastrous impact on the retail industry, driving dozens of firms into bankruptcy, shutting down tens of thousands of stores, and costing hundreds of thousands of jobs nationwide.

The November 2020 version of “Where Members of the 116th Congress Stand on Financial Reform” documents how Members voted on over thirty legislative measures concerning consumer protections, housing, Wall Street and the financial industry, from January 2019 to November 2020.

AFR released a recommended set of systemic reforms outlining steps to create a safe and just financial system. These include both reversing the deregulation of the Trump years and taking positive steps to create a far more secure and inclusive financial system. The full document

Kathleen Kraninger, the current director of the Consumer Financial Protection Bureau, told an audience of bankers at a November 2019 industry gathering that “you are really helping drive the agenda.” Unfortunately for the public and for consumer financial protection, the Kraninger agenda and the Wall Street lobby’s priorities are indeed all too similar, even during the COVID-19 pandemic and massive economic distress.

While it’s true that the largest banks currently look solvent in the face of economic stress, this is in significant part because they have benefited greatly from regulatory forbearance and from Federal Reserve intervention in financial markets. This report, based on analysis of regulations and bank financial reports by Americans for Financial Education Fund and Risky Finance, lays out some of the clearest ways in which the nation’s six largest banks have benefited from regulatory forbearance and the Federal Reserve’s financial market interventions.