News Release: EPIC and Americans for Financial Reform Oppose Attempt to Strip Away Payment App Protections

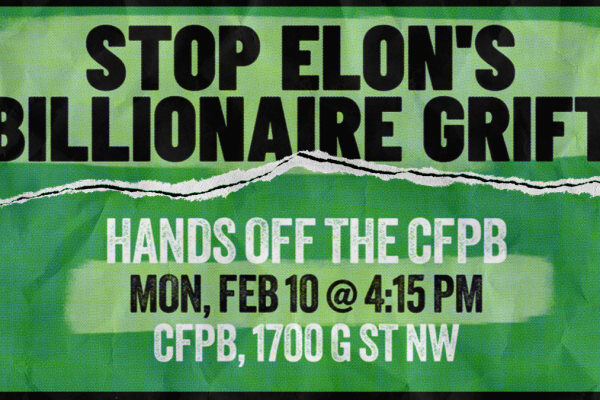

EPIC and Americans for Financial Reform (AFR) oppose the Trump Administration’s recent attacks on the CFPB and efforts by Congress to overturn finalized CFPB rules that protect users of payment apps. These attacks put Americans’ privacy and financial wellbeing at risk and threaten to destabilize the financial industry.