NEWS RELEASE: Private Equity Looting Drove J. Crew Bankruptcy

Private equity firms loaded J. Crew with debt and hid assets away from investors and creditors.

Private equity firms loaded J. Crew with debt and hid assets away from investors and creditors.

Yesterday, the Internet Corporation for Assigned Names and Numbers (ICANN) rejected the proposed private equity takeover of the Public Interest Registry (PIR), the non-profit that manages the non-commercial, charity, and non-profit internet domain registry for all Dot-Org websites. The decision recognized that the private equity debt loads and extractive business model would hinder Dot-Org’s ability to serve its non-profit clients without raising prices, compromising service, creating new revenue streams that comprise users’ data and privacy, or otherwise imposing unfair costs on 10 million organizations.

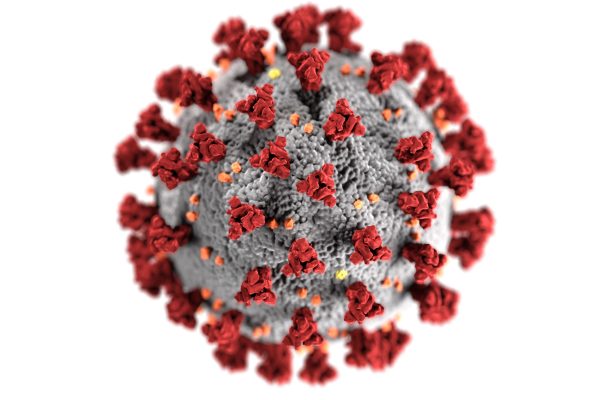

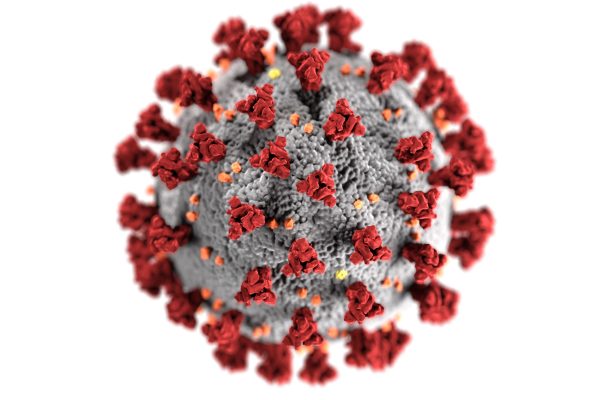

Absent major changes, the Federal Reserve’s multi-trillion-dollar funding programs will reward corporate insiders and financial speculators, without guaranteeing desperately needed help for those hardest-hit by the coronavirus crisis. The Fed needs to set the right priorities for this credit and impose conditions that ensure the benefits of this extraordinary assistance go to those who need it most.

The National Consumer Law Center, Americans for Financial Reform Education Fund, the National Fair Housing Alliance and 33 other consumer, civil rights, and housing counseling groups sent a letter today calling on the Federal Housing Finance Authority (FHFA) to step up its efforts to translate key mortgage notices needed by borrowers hit hard by the COVID-19 pandemic.

Corporate and Wall Street titans have used the coronavirus crisis to grab windfalls as a price for putting desperately needed resources into health care and helping people facing acute distress after losing jobs and income. The Trump administration and too many members of Congress actively promoted this terribly unbalanced approach to a public health emergency. The federal government – Congress and the executive branch – must move swiftly beyond what is in this legislation to help struggling people, families and communities in a just and inclusive manner. More needs to be done to respond to this crisis.

Today, under the cover of a national crisis, five federal bank regulators issued small dollar bank lending guidance that lacks the consumer protections needed to ensure loans do not trap borrowers in a cycle of debt.

FOR IMMEDIATE RELEASE: March 24, 2020 National Consumer Law Center Contacts: Sarah Bolling Mancini (smancini@nclc.org), Odette Williamson (owilliamson@nclc.org), or Jan Kruse (jkruse@nclc.org) Advocates: HUD Must Do Much More to Protect Older Reverse Mortgage Borrowers in the Coronavirus Epidemic The National Consumer Law Center, Americans for

The COVID-19 pandemic requires an aggressive economic response that creates the best possible conditions to preserve public health and helps individuals, families, and communities weather the disruptions that efforts to contain the pandemic require.

The U.S. Supreme Court is preparing to hear oral arguments on Tuesday, March 3, on Seila Law v. Consumer Financial Protection Bureau (CFPB). The case is about whether the authority of this independent agency, led by a single director who can be removed only for cause, violates the separation of powers.

The supplemental rule states that debt collectors must provide consumers with specific disclosures when collecting debt that is beyond the statute of limitations (time-barred debt). The proposed disclosures would be in addition to the CFPB’s proposal announced in May to prohibit collectors from filing or threatening a lawsuit on a time-barred debt, but only if the collector “knows or should know” that the legal time limit to sue has expired.