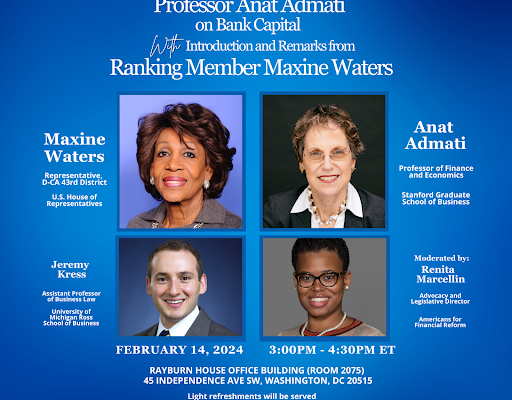

Event: Ranking Member Waters, Professor Anat Admati and Professor Jeremy Kress debunked myths about bank capital at Admati’s book event

Americans for Financial Reform, together with Better Markets, welcomed Anat Admati, Professor of Finance and Economics at the Stanford School of Business, together with esteemed panelist, Assistant Professor of Business Law at Michigan Ross, Jeremy Kress, to discuss the recent update to Anat’s co-authored book, The Bankers’ New Clothes: What’s Wrong with Banking and What to Do about It, which debunks myths about bank capital.