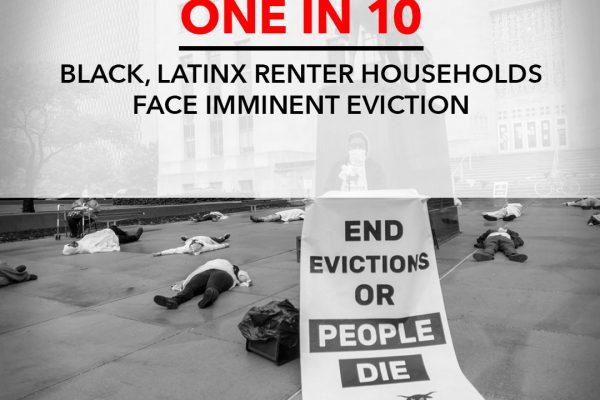

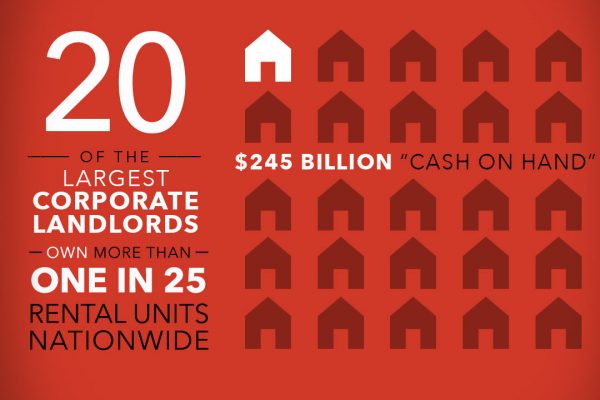

News Release: Billionaire Landlords Profit by $24.4 Billion and Hoard Cash as Millions Face Eviction During the Pandemic

Billionaire corporate landlords have increased their wealth by $24 billion and have raised over $245 billion as millions of American families face a wave of evictions.