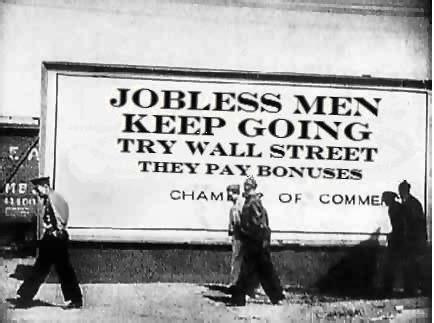

Sen. Tester: Senate bill would put referees on Wall Street

Opinion by Sen. Jon Tester Published in the Billings Gazette March 21, 2010 You’ve probably already seen the ads on TV or heard them on the radio. Out-of-state groups are shelling out millions to sway your opinion on a very important bill I’m working on