No Offshore End-Run Around Derivatives Reform

Tell Washington to stand firm against Wall Street’s latest strategy of evasion.

Tell Washington to stand firm against Wall Street’s latest strategy of evasion.

Litigation Daily’s Susan Beck nudges the probable next SEC chair to take on the rating agencies and their built-in conflict of interest.

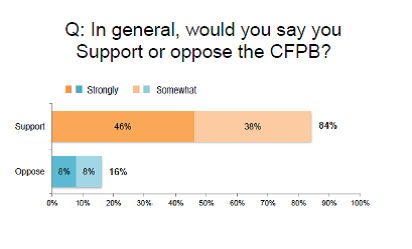

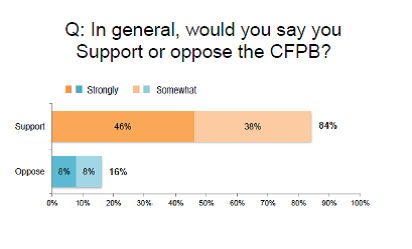

84% say they support the consumer Bureau, and most are Republicans in a new poll commissioned by Small Business Majority and sponsored by the Center for Responsible Lending

While Republicans threaten to once again insist on weakening changes in the CFPB’s governing structure before considering a nominee for director, Richard Cordray may be winning over some elements of the banking world, according to Bloomberg.

“Wall Street special interests have opposed tough rules every step of the way. We need leadership at the SEC that will resist that pressure and move swiftly forward [to] protect the markets and investors.”

“The Senate now has a second chance to confirm this commendable nominee. It should.”

Two and a half years after passage of the Dodd-Frank Act, two-thirds of its mandated rules have yet to be issued, and more than a hundred of its deadlines have been missed, writes Mark Gongloff of the Huffington Post. “Meanwhile, no banker has yet gone

“Mortgage servicers will face greater limits on their ability to foreclose on a borrower while simultaneously negotiating a loan modification under new rules issued by the U.S. Consumer Financial Protection Bureau,” Bloomberg’s Carter Dougherty reports. The new rules “go further” than the bureau’s first proposal

“[W]hile the final rule is an improvement over the proposed rule, it does not go far enough to ensure fair treatment of borrowers. We urge the CFPB to immediately consider improvements, both on its own and through the interagency guidance process.”

AFR Executive Director Lisa Donner talks to NPR about the importance of holding mortgage lenders accountable for unaffordable loans.