Tapping into the strong anti-Wall Street sentiment, on July 13th, Representative DeFazio reintroduced his financial transaction tax legislation as the “Putting Main Street FIRST Act: Finish Irresponsible Reckless Speculative Trading Act.” The reintroduction of this bill comes with a fresh score from the Joint Committee on Taxation. The Act would implement a .03% tax on Wall Street trading, generating an additional 417.4 billion dollars in revenue over 10 years for the restoration of Main Street.

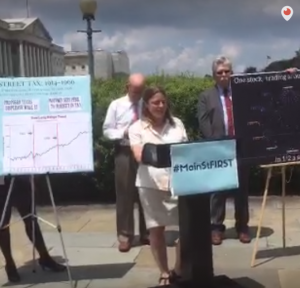

The legislation reintroduction was announced at a press conference kicked off by Representative DeFazio summarizing his legislation and detailing the need for a tax on Wall Street activity. His speech was followed by a number of AFR partners: President Christopher Shelton of Communication Workers of America on behalf of the Take On Wall Street Campaign, Lisa Gilbert of Public Citizen, Dean Baker of Center for Economic Policy Research, Damon Silvers of AFL-CIO, and AFR’s Lisa Donner concluded the event, calling those present to take part in ensuring Wall Street pays its fair share, with a reminder that interest in the legislation would continue to grow.

A joint statement of AFR partners from the press conference with Representative DeFazio was circulated, and coalition partners shared on various forms of social media, posts leading up to and during the announcement.

The tax aimed at curbing Wall Street speculation and taxing trades as a means to generate revenue, is unpopular with Wall Street banks. The launch of the “Putting Main Street FIRST Act” has been met with nearly a dozen of slanted articles distorting facts about the impact of a financial transaction tax. The attacks on a Wall Street speculation tax is nothing new. Coalition partners have responded to industry-oriented commentaries noting such, while urging members of Congress to move forward with the Main Street FIRST Act. See more of the press conference here.

The tax aimed at curbing Wall Street speculation and taxing trades as a means to generate revenue, is unpopular with Wall Street banks. The launch of the “Putting Main Street FIRST Act” has been met with nearly a dozen of slanted articles distorting facts about the impact of a financial transaction tax. The attacks on a Wall Street speculation tax is nothing new. Coalition partners have responded to industry-oriented commentaries noting such, while urging members of Congress to move forward with the Main Street FIRST Act. See more of the press conference here.