Category Archives: Congressional Testimony

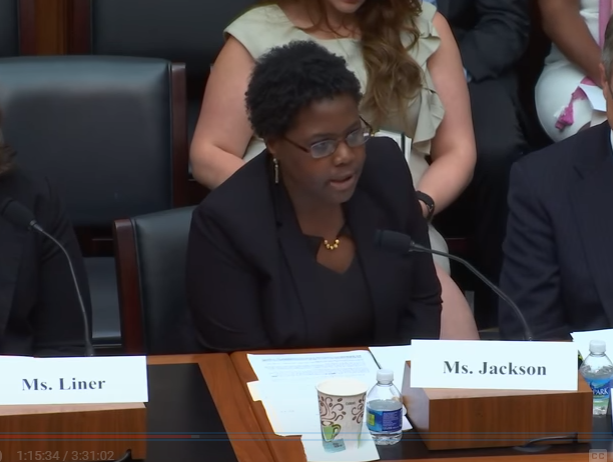

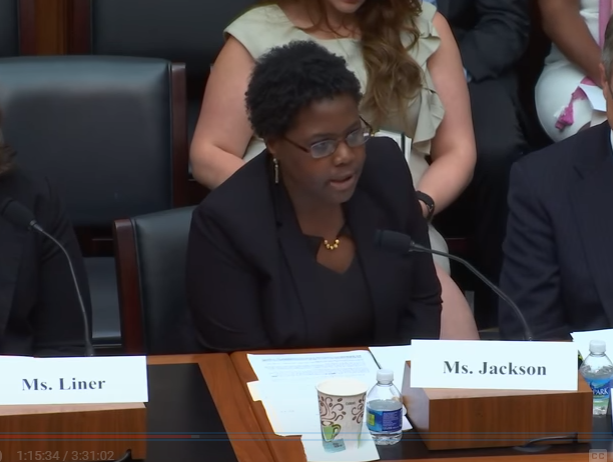

AFR Testimony: Reject Wall Street’s CHOICE Act

“This legislation would be better dubbed ‘Wall Street’s CHOICE Act,’ because it would have a devastating effect on the capacity of regulators to protect the public interest and defend consumers from Wall Street wrongdoing and the economy from risks created by too-big-to-fail financial institutions.” — testimony at House Financial Services Committee hearing, April 26

Joint Statement: The CFPB’s Work Is Important to Military Families and Veterans

“There is a clear and compelling public interest that Congress continue to support vigorous enforcement of laws that protect military families from wrongful financial practices… [T]he strong record of the Consumer Financial Protection Bureau and its Office of Servicemember Affairs underscores the need for Congress to resist efforts that seek to hamstring this work. Tampering with the agency’s authorities, structure, and independence would be harmful to military families and honest companies across the country.”

AFR Testimony: Testimony to SEC Investor Advisory Committee Hearing

In the new political environment, it is likely that there will be a heavy emphasis on the capital formation mission of the SEC. The IAC should play a critical role in reminding the Commission that investor protection is crucial to stable and effective capital formation. …Improving financial entity disclosures is crucial if we are to improve market discipline for large financial entities and investor discipline for funds.

AFR Testifies on Importance of the Financial Stability Board and Regulation of Shadow Banking

“In considering the topic of today’s hearing – the implications of the Financial Stability Board for U.S. growth and competitiveness – I believe the starting point should be the actual powers and responsibilities of the Financial Stability Board (FSB). “

AFR Policy Director, Marcus Stanley, Testimony Before Small Business Committee

“Today’s hearing asks us to consider the impact of the Dodd-Frank Act on small banks. I want to make two broad points. First, community banks face economic headwinds that are unrelated to Dodd-Frank, connected both to long-term trends and to the effects of the financial crisis itself. Second, the big picture is that community banks have returned to profitability under Dodd-Frank. In 2015, over 95% of community banks earned a profit – up from just 78% in 2010, the year Dodd-Frank was passed.”

AFR Statement: AFR Statement for the Record on the Senate Banking Committee Hearing “Assessing the Effects of Consumer Finance Regulations”

“It is less than five years since the Consumer Financial Protection Bureau (CFPB) was established. Since then, the CFPB has fulfilled Congress’s vision of a federal agency with “the authority and accountability to ensure that existing consumer protection laws and regulations are comprehensive, fair, and vigorously enforced.”

AFR Testifies Before House Financial Services In Opposition To Legislation That Would Roll Back Reforms of Securitization Market

“We oppose these efforts to roll back post- crisis reforms. It is particularly ironic that they are being advanced in the name of “increasing liquidity”. A central lesson of the crisis is that market liquidity can be excessive, and that such excessive liquidity leads to disastrous market crashes that have far more damaging liquidity effects than those that might be created by prudent limits on excessive leverage and risk-taking in normal markets.”

AFR Testimony: AFR Testifies on Legislation that Would Rollback Financial Reform

“Chairman Neugebauer, Ranking member Clay, and members of the Committee, thank you for the opportunity to testify before you today on behalf of Americans for Financial Reform. AFR opposes HR 2287 (NCUA Budget Transparency Act), HR 2896 (the TAILOR Act), and HR 3340 (the Financial Stability Oversight Council Reform Act). We also have concerns regarding HR 2209 (requiring the treatment of certain municipal debt obligations as level 2A assets under liquidity rules).”

AFR Testimony: Expansion of ERISA Fiduciary Duty Protection is “Long Overdue”

“Over the forty years since the existing DOL rule was written, retirement markets have transformed and workers have become overwhelmingly reliant on self-directed savings. Due to the loopholes in the current rule, brokers providing advice on such self-directed savings can easily evade the fiduciary protections that Congress intended to provide to workers saving for their retirement through employment-based plans.”