FACT SHEET: The Cost of the 2008-2010 Financial Crisis in Sixteen Charts

Sixteen charts showing the lasting impact of the financial crisis on family finances and inequality.

Sixteen charts showing the lasting impact of the financial crisis on family finances and inequality.

In many ways, the private equity industry embodies some of the worst impulses of Wall Street, squeezing profits at the expense of workers and consumers, and insulating bad actors from risks. But these abuses are not inevitable. On the contrary, they are the result of laws and regulations that can and should be changed.

For over 45 years, the disparate impact doctrine has allowed people to chip away at policies that have a discriminatory effect even if there is no intent to discriminate. When the need to address systemic racism is so urgent, and the costs of failing to do so are so devastating, HUD has chosen to finalize a rule that effectively dismantles this essential tool for fighting injustice.

AFR and our national partners submitted detailed comments opposing the OCC’s proposed true lender rule.

Letter from 101 groups opposing OCC’s true lender rule

Wall Street has consistently opposed the return of postal banking since its destruction in the 1960s. Chase and other nefarious actors are attempting to prevent competition before it even forms. The 2020 Democratic Party Platform and Biden-Sanders Unity Task Force recommendations both call for postal banking. But they also call on policymakers to separate retail banking institutions from more risky investments and protect consumers from high rates, onerous fees, inequitable credit reporting, and other harms.

“So many fundamental decisions about how the economy works, and who it works for, and who is excluded are made through the decisions we make about finance,” [AFR Executive Director Lisa Donner] said. “There is a huge opportunity to have a transformative impact.”

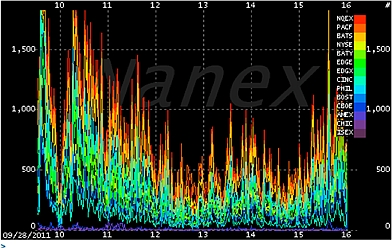

The AFR Education Fund wrote a letter to the Commodity Futures Trading Commission regarding its proposed new “Electronic Trading Risk Principles”. The letter faulted the principles-based approach as basically allowing Wall Street to regulate itself in this important area. A copy of the letter can

Letter to CFPB urging focused outreach to LEP mortgage borrowers during COVID-19 and expanding language access in mortgage origination and servicing.

“At these prices, this is not a market screaming, ‘We need help from the Fed,’” said Andrew Park, senior policy analyst at Americans for Financial Reform, which advocates for tighter financial rules on Wall Street.