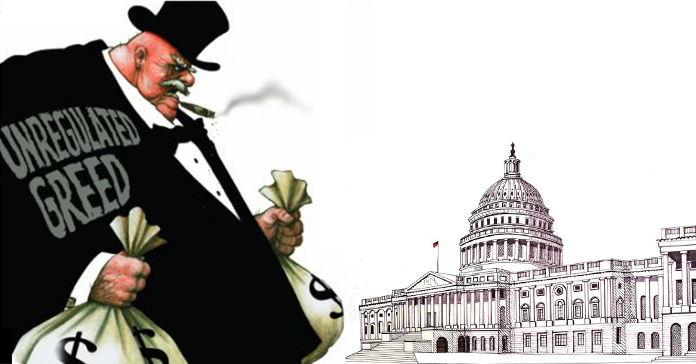

AFR Report: Warren Endorses Need for Action on Wall Street Role in Home Rental Market

In the past 10 years, nine big Wall Street firms have fundamentally altered the rental landscape in their targeted cities across 13 states by eliminating the human aspects of the relationship between tenants and their landlord. In some areas, the largest SFR companies own a large percentage of all single family rentals in a given zip code – up to 12.5 percent in some areas.