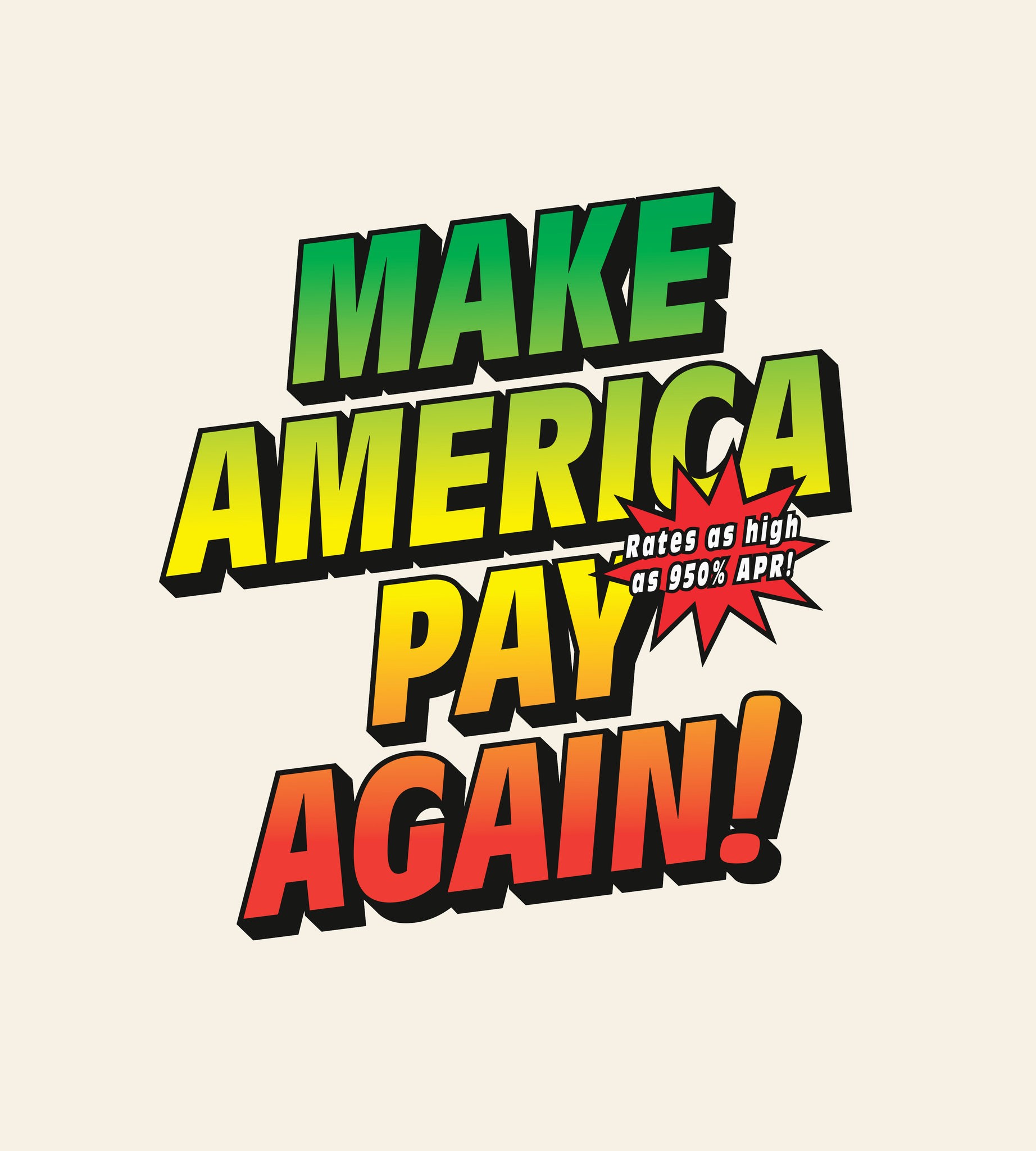

In the News: Trump suspends interest on all federal student loans to ease financial impact of coronavirus

“With so many facing the prospect of lost wages or lost jobs, the government can and should do more than waive interest, which is merely an economic Band-Aid on the gaping financial wound the pandemic is causing,” said Alexis Goldstein, senior policy analyst at the liberal think tank Americans for Financial Reform. “The Education Department has the authority to cancel student debt, and using it would mean both short- and medium-term economic stimulus that helps all Americans.”